The company recorded these purchases in its books using the following journal entries. A purchase returns and allowances account is simply a virtual account that exists solely to show the net effect of all transactions relating to returns and allowances. The refunds and other allowances given by suppliers on merchandise originally purchased for resale are known as purchase returns and allowances. Moreover, managing purchase returns effectively can enhance supplier relationships.

Role in Inventory Management

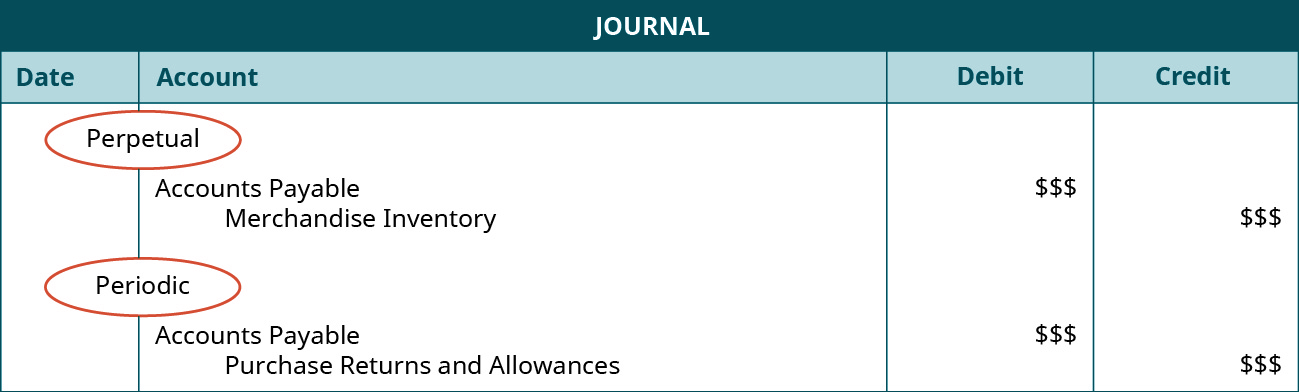

This is due to, under the periodic system, the company does not record the inventory either when it makes the inventory purchase journal entry. Like purchase returns, purchase allowances can also occur due to various reasons. A purchase allowance is a reduction in the price of goods or services after delivery.

Purchases Returns and Allowances Journal

The main reason for not deducting it directly from purchases is to keep the accounting records properly maintained for auditing and internal controls. Purchase return isn’t exactly a gain or an income for the company, however, it reduces liability (in case of credit purchase), therefore, it indirectly acts as a gain. In this case, $1,500 will be offset with the amount of purchase during the period when the company calculates the cost of goods sold. All the above reasons can give rise to a purchases return for companies.

Purchase return journal entry

However, they were still usable, so the company decided to keep them. In exchange, the suppliers provided the company with a purchase allowance of $25,000 and a reduction in payable balances. When companies purchase goods from suppliers, they may also offer a purchase returns policy. Usually, companies get raw materials or finished goods from external sources. Usually, the purchase process begins with a company identifying the need to buy raw materials or finished goods.

Format and posting of sales returns and allowances journal

However, others may maintain both of them under the same account due to their similar nature. Regardless of its presence in the books, both accounts reduce the purchases figure in the financial statements. However, missing an irs form 1099 for your taxes keep quiet, don’t ask they do not directly impact the purchases account in the general ledger. If you need to refund a customer for a purchase they made from your business, you will need to create a purchase return journal entry.

- Like purchase returns, purchase allowances can also occur due to various reasons.

- In this journal entry, the company directly reverses the inventory back in the amount of the returned goods.

- In merchandising, a return occurs when a customer returns to the seller part or all of the items purchased.

- These records are then posted into the General Ledger, where they become part of an overall return and allowance account that can be used to offset inventory purchases.

- Rather than refunding a customer with cash, you might credit merchandise at your business.

Purchase Discounts, Returns and Allowances are contra expense accounts that carry a credit balance, which is contrary to the normal debit balance of regular expense accounts. In this journal entry, both assets (inventory) and liabilities (accounts payable) are reduced by $1,500 for the purchase return transaction. A company, ABC Co., made total purchases of $500,000 during the last accounting period.

Sometimes goods purchased by a business are unfit for use and may need to be returned to the respective supplier(s). This may happen due to several different reasons, in business terminology, this action is termed purchase returns or return outwards. Journal entry for purchase returns or returns outwards is explained further in this article. When it returns these goods to the supplier, the accounting entries may differ. However, companies do not record this transaction since it results in a net effect of zero.

If a customer made a cash purchase, decrease the Cash account with a credit. Return outwards or purchase returns are shown in the trading account as an adjustment (reduction) from the total purchases for an accounting period. Despite the advantages mentioned above, there are a few factors that prove to be a hassle. Let us understand the disadvantages of credit or cash purchase return journal entries through the discussion below.

Clear communication and established return policies with suppliers can streamline the return process, reducing the time and effort required to handle returns. This collaboration can also lead to better terms and conditions in future transactions, as suppliers appreciate the transparency and efficiency in dealing with returns. Additionally, analyzing return data can provide valuable insights into supplier performance, helping businesses identify reliable partners and address any recurring issues with specific suppliers.

Accounts payable is a current liability with a normal credit balance (credit to increase and debit to decrease). Whenever we are the buyer, use a combination of these 3 accounts only. Purchase Returns Account is a contra-expense account; therefore, it can never have a debit balance.