Assets financed by investors and common inventory will be listed as shareholder’s equity on your balance sheet. Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

Assets

Individual transactions which result in income and expenses being recorded will ultimately result in a profit or loss for the period. The term capital includes the capital introduced by the business owner plus or minus any profits or losses made by the business. Profits retained in the business will increase capital and losses will decrease capital. The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities.

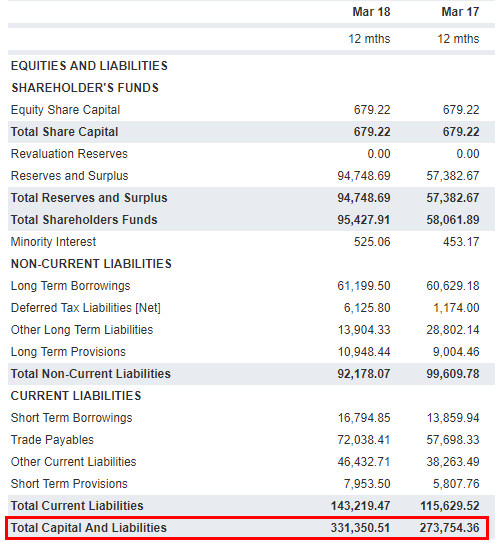

- The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time.

- Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity.

- As inventory (asset) has now been sold, it must be removed from the accounting records and a cost of sales (expense) figure recorded.

- The accounting equation equates a company’s assets to its liabilities and equity.

Great! The Financial Professional Will Get Back To You Soon.

If the net amount is a negative amount, it is referred to as a net loss. An accounting transaction is a business activity or event that causes a measurable change in the accounting equation. Merely placing an order for goods is not a recordable transaction because no exchange has taken place.

Cash ratio equation

In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses. Taking time to learn the accounting equation and to recognise the dual aspect of every transaction will help you to understand the fundamentals of accounting. Whatever happens, the transaction will always result in the accounting equation meet brittany cole bush balancing. The inventory (asset) of the business will increase by the $2,500 cost of the inventory and a trade payable (liability) will be recorded to represent the amount now owed to the supplier. The third part of the accounting equation is shareholder equity. The revenue a company shareholder can claim after debts have been paid is Shareholder Equity.

accounting formulas every small business owner should know

Due within the year, current liabilities on a balance sheet include accounts payable, wages or payroll payable and taxes payable. Long-term liabilities are usually owed to lending institutions and include notes payable and possibly unearned revenue. The accounting equation states that the amount of assets must be equal to liabilities plus shareholder or owner equity. After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business.

Part 2: Your Current Nest Egg

That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side. Anushka will record revenue (income) of $400 for the sale made. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future. As inventory (asset) has now been sold, it must be removed from the accounting records and a cost of sales (expense) figure recorded.

During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. Interest (ie finance costs) are an expense to the business. Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60. The difference between the sale price and the cost of merchandise is the profit of the business that would increase the owner’s equity by $1,000 (6,000 – $5,000).

On 28 January, merchandise costing $5,500 are destroyed by fire. The effect of this transaction on the accounting equation is the same as that of loss by fire that occurred on January 20. On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable. This transaction would reduce an asset (cash) and a liability (accounts payable). On 10 January, Sam Enterprises sells merchandise for $10,000 cash and earns a profit of $1,000.

While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets. Does the stockholders’ equity total mean the business is worth $720,000? For example, although the land cost $125,000, Edelweiss Corporation’s balance sheet does not report its current worth. Similarly, the business may have unrecorded resources, such as a trade secret or a brand name that allows it to earn extraordinary profits. Alternatively, Edelweiss may be facing business risks or pending litigation that could limit its value.

The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof.